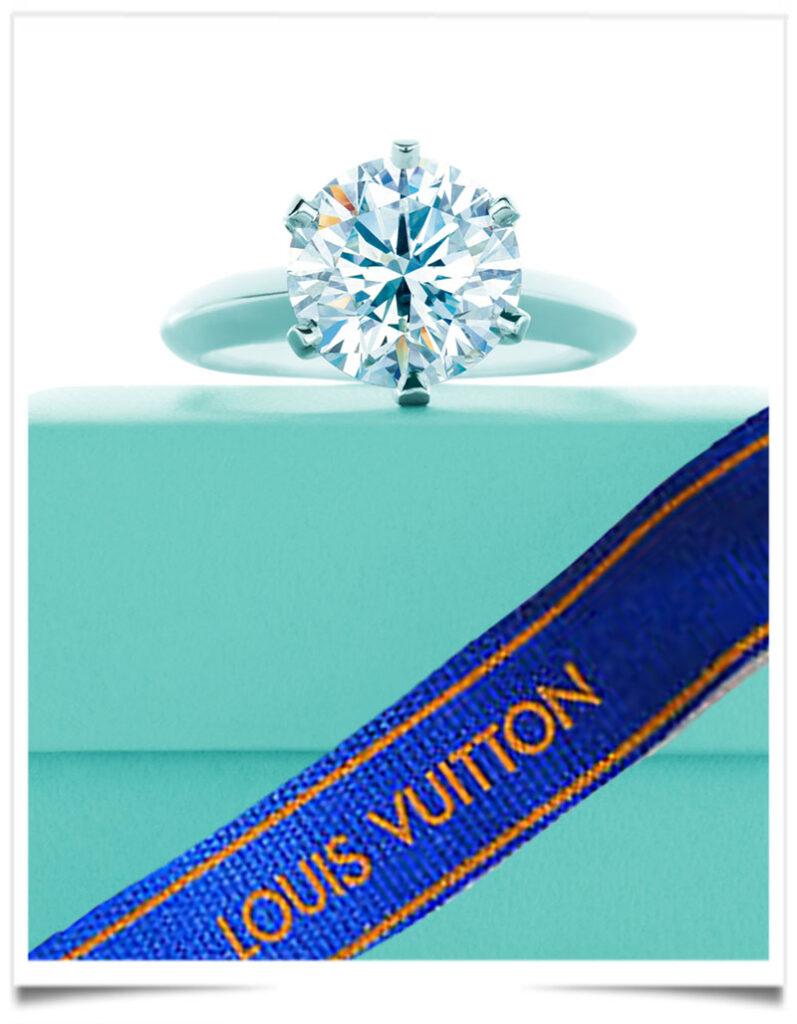

The biggest diamond stone in the world. Tiffany has unveiled most expensive Design in its history? It was last Sunday at a Tiffany event in Dubai, The World’s Fair Necklace the biggest diamond stone in the world was unveiled with a total 180 carats of diamonds, all set in platinum. At its center is an 80-carat oval shape, D color and internally flawless diamond that Tiffany has christened “The Empire Diamond,” named for the New York City icon in the jeweler’s hometown. Continue reading

It is understood board members of the luxury giant are concerned about the impact of not only the coronavirus pandemic, which has claimed more than 100,000 lives in America and wreaked widespread economic damage, but also the growing social unrest over the death of George Floyd at the hands of Minneapolis police.

It is understood board members of the luxury giant are concerned about the impact of not only the coronavirus pandemic, which has claimed more than 100,000 lives in America and wreaked widespread economic damage, but also the growing social unrest over the death of George Floyd at the hands of Minneapolis police.